Assembly Bill 1175, Landmark Legislation Modernizing CPA Licensure in California

The California Board of Accountancy (CBA) is proud to announce that Assembly Bill (AB) 1175, the CBA’s sponsored legislation to enhance the requirements for CPA licensure and modernize mobility in California, was signed into law by the Governor on October 3. Assembly Bill 1175, authored by Assemblymember Jacqui Irwin, was introduced on February 21, 2025, passed by the Assembly in May, and the Senate in September without a single “nay” vote.

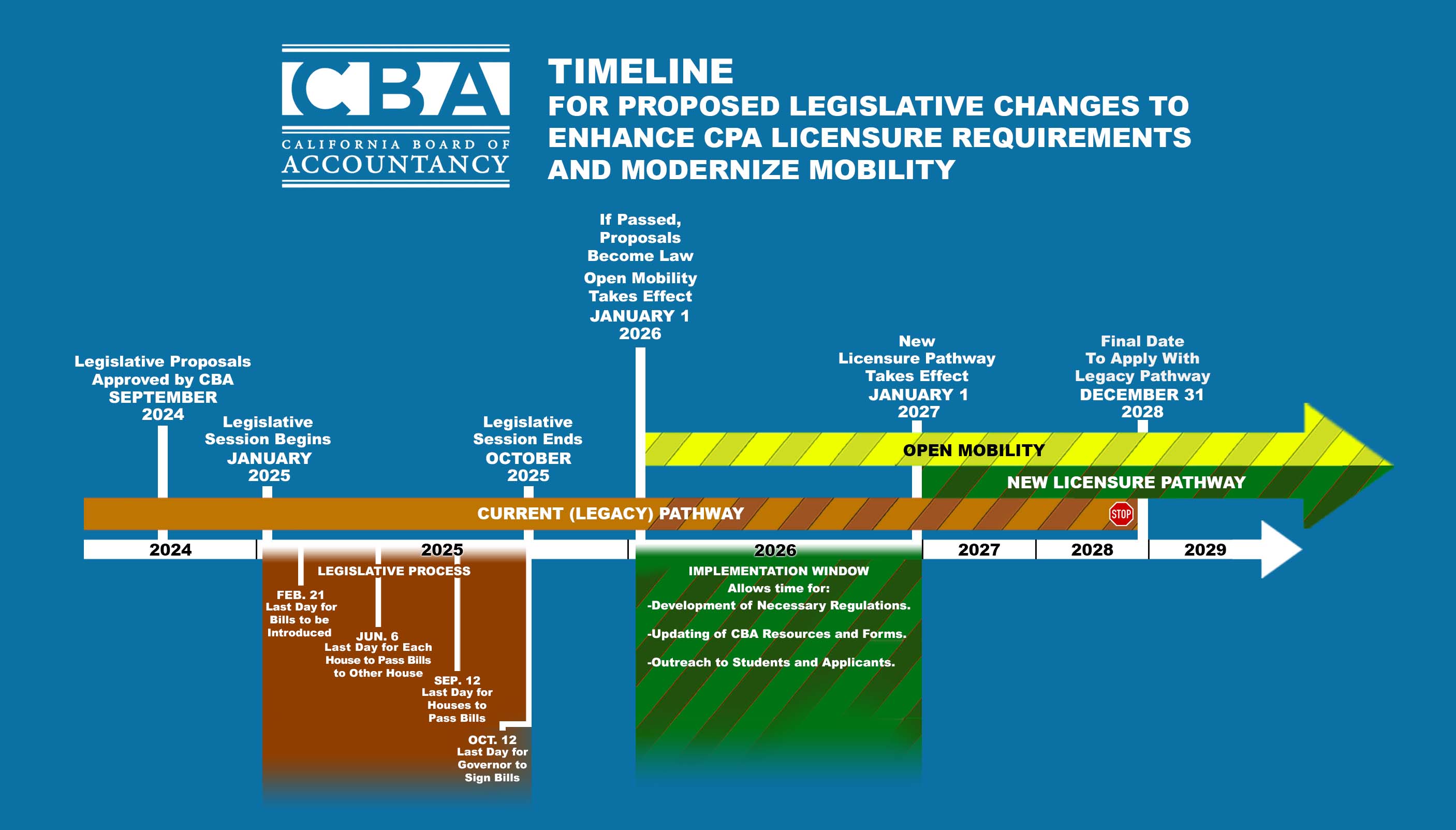

AB 1175 takes effect on January 1, 2026, although there will be a 12-month implementation period before the enhanced licensure requirements kick in on January 1, 2027. This window allows the CBA time to complete the rulemaking process to put in the place the regulations which will help implement and specify certain elements of the bill, as well as develop the recognition program of university degrees and community college/extended studies certificates.

During the two calendars years 2027 and 2028, both sets of requirements (the current, or “legacy,” requirements as well as those put forward in AB 1175) will be valid roads to CPA licensure in California. From 2029 onwards, only the new requirements will provide eligibility for licensure.

The CPA licensure requirement enhancements of the bill make the pathway to licensure more flexible for aspiring CPAs, while maintaining the high standards required to ensure consumer protection. The new provisions seek to focus the educational requirements on the degree earned, instead of a particular number of units.

Key elements of the bill are:

Establishes the minimum educational requirements as a bachelor's degree with an accounting concentration of courses, and eliminates the total unit requirement of 150 semester units.

Allows for a reduction in the minimum accounting concentration unit requirement by eliminating non-relevant courses (e.g. architecture and philosophy).

Increases the experience requirement and authorizes the CBA to accept specified advanced degrees to substitute up to one year of experience. Also allows the CBA to substitute the completion of specific certificates or training programs for part of the experience requirement.

Aligns the educational requirements to be the same for examination and licensure to provide increased clarity.

Authorizes the CBA to recognize specific degrees as meeting all educational requirements, thereby creating an "expressway" for transcript review purposes.

As is displayed in the first box, the minimum educational requirements now consist of a bachelor’s degree with an accounting concentration (see the Related Regulations section for more details). The elimination of the 150 total unit requirement addresses the potential barrier to entry into the profession that a costly fifth year of school poses, especially within minority communities. Flexible licensure requirements create opportunities for a more diverse and skilled workforce to enter the profession. Having enough CPAs to meet the high demand for critical financial services in the future is paramount to ensuring consumers have access to competent and ethical CPAs they can trust.

The mobility provisions of the bill seek to create an open mobility framework instead of relying on the substantial equivalency of each state’s licensure requirements. This would allow states to alter licensure requirements to suit their needs without disrupting mobility. Should the CBA determine a state is not providing the proper consumer protection, it could remove the ability for that state’s licensees to practice with no notice in California. This is in addition to the safeguards already in place regarding practice privilege for out-of-state licensees.

BACKGROUND

The CBA approved a legislative proposal in the fall of 2024 to enhance the requirements for CPA licensure and modernize mobility in California. The proposal was the culmination of many months of collaborative discussions as part of the CBA’s Students Understanding the Requirements to be a CPA Project – or SURE CPA Project for short.

There were extensive information-gathering activities including surveys, townhall meetings, focus groups, and presentations from the American Institute of Certified Public Accountants (AICPA), National Association of State Boards of Accountancy (NASBA), and the California Society of Certified Public Accountants (CalCPA).

- Click here to read in greater detail about the CBA’s activities from 2023-2024 referenced above that led up to the proposal.

CBA MEETING DISCUSSIONS

- Click here to watch CBA meetings from 2023-24 where the SURE CPA Project and legislative proposal was discussed, and read the complete papers on the topics presented at the meetings. Click on the month to watch the meeting or click on the item number to read the paper.

LEGISLATIVE PROCESS

The legislative proposal was officially introduced as Assembly Bill 1175, and began to work its way through the legislative process. The 2025 legislative session took place during the spring and summer, with the ultimate deadline of September 12 to pass bills to the Governor’s desk. AB 1175 reached the Governor’s desk on September 9, after facing no opposition during any stage of the legislative process. The bill was signed into law on October 3.AB 1175 passed out of the Assembly Business and Professions Committee and Assembly Appropriations Committee in April, and came up for a floor vote and was passed by the full Assembly on May 5. It was amended three times in the month of April, the most notable change being the moving of the effective date for the licensure requirement changes from July 1, 2026, to January 1, 2027. The original bill language allowed the CBA to pursue “emergency” regulations, which would have allowed for swifter finalization of the regulatory changes. An April 28 amendment removed the authority for the emergency regulations, meaning the CBA would move through the normal regulatory timeline to implement the portions of the bill which will be specified in regulations.

A similar process happened in the Senate, as the bill passed out of the Senate Business, Professions and Economic Development Committee in July, and was deemed not to have a significant fiscal impact allowing it to not be heard in the Senate Appropriations Committee. The Senate passed AB 1175 in a floor vote in early September, and the bill was officially presented to the Governor on September 9.

The timeline below shows that now that the law has been passed, it will take effect on January 1, 2026. The mobility provisions will begin at that point, but there will be a 12-month implementation window before the new licensure requirements take effect on January 1, 2027. The legacy requirements will remain as an option until December 31, 2028.

RELATED REGULATIONS

Assembly Bill 1175 was written to allow for certain details to be established in regulations. Throughout much of 2025, the CBA had discussions about those details, including the unit requirements for the “accounting concentration.” After engaging in stakeholder input, the CBA approved the following to make up the accounting concentration:

- 24 semester units of accounting courses

- 24 semester units of business-related courses (extra accounting or ethics units also count here)

- 3 semester units of ethics

At its May 2025 meeting, the CBA reviewed and adopted several staff-recommended policy proposals including recognizing specific accounting degrees to completely meet the educational requirements. Applicants will not be required to earn one of these “CBA-recognized” degrees to qualify for the CPA Exam or licensure, but recognized degrees would provide peace of mind that they have met all of the educational requirements. Degrees with accounting concentrations or minors could potentially also be recognized.

As added flexibility for those whose undergraduate degree is in a subject other than accounting, the CBA also approved that recognized accounting certificates from institutions such as community colleges or extended studies programs should substitute for six months of the general accounting experience requirement. These certificates would need to satisfy the “accounting concentration of courses” educational requirement and must be acknowledged on an official transcript. Certificates cannot be used in place of a bachelor’s degree and cannot be issued in conjunction with a recognized degree.

This program will be put into place with California colleges and universities during the 12-month implementation window in 2026 to be ready to launch in 2027 when the new requirements go into effect.

The proposed regulations will also spell out which advanced degrees would substitute for one year of the general accounting experience requirement. Applicants with a bachelor’s degree in any subject, including accounting, can earn a master’s in accounting, taxation, or tax law to qualify for this substitution. If the undergraduate degree is in accounting, then there are broader options of fields the master’s degree could be in, also specified in the regulations.

The CBA is moving forward with the rulemaking process, and will release regulations for public input once that step of the process has been reached.

NATIONAL PERSPECTIVE

California is by no means the only state moving forward with potential changes to the CPA licensure requirements. More than 20 other states currently have pending legislation that would create a new pathway similar to what California is proposing. The mobility provisions of AB 1175 allow flexibility for other states to modify their licensure requirements without jeopardizing mobility by moving to a CPA=CPA model. No longer would California be required to recognize other states as being “substantially equivalent” when it comes to licensure requirements. An individual licensed in another state would be allowed to practice public accountancy in California without notice, much like drivers licensed in another state are allowed to drive in California.

CBA CAMPUS TOUR

Aspiring CPAs who are currently working towards graduation and licensure will be the most impacted by these changes, as they will likely be able to choose between the ‘legacy’ requirements and the new AB 1175 requirements. As a result, the CBA launched an outreach initiative labelled the “CBA Campus Tour” in Fall 2025, aiming to reach as many accounting students and faculty members with this information as possible across California through a series of virtual and on-campus events. Find out more about the CBA Campus Tour here.

MULTIMEDIA

Videos

National Articles About CBA Legislation

Podcasts

- Accounting for California Podcast (Episode XIII: July 2025) (Episode XI: March 2025) (Episode IX: October 2024) CBA Executive Officer Dominic Franzella and CalCPA President & CEO Denise Froemming discuss the legislative proposals approved by the CBA aimed at enhancing CPA licensure requirements and modernizing mobility within California.

- Bloomberg Tax: California Explores Relaxing CPA Education Rules

California Society of Certified Public Accountants

- Read about what CalCPA is doing to inspire the next generation of accounting professionals.

Other Articles About Licensure Changes and Accounting Profession

- ‘150-hour rule’ for CPA certification causes a 26% drop in minority entrants

- The Accountant Shortage Is Showing Up in Financial Statements

- Cities’ Credit Ratings Are at Risk Because There Aren’t Enough Accountants

- Op-ed from KPMG CEO with relevant data points

FAQs

What is flexible about the proposed licensure requirements?

The bill establishes a single set of requirements to meet the “Three Es” of education, examination, and experience:

- Baccalaureate degree and an accounting concentration of courses

- Uniform CPA Examination

- Two years of general accounting experience

How does the bill provide increased clarity for an Aspiring CPA?

A single set of licensure requirements is simple and easy to understand, especially compared to a multiple pathway approach. Additionally, the bill authorizes the CBA to recognize specific degrees as fully meeting the educational requirements. Students enrolled in CBA-recognized degree programs would have confidence that by earning that degree they would meet the minimum educational requirements for examination and licensure.

Will students need to attend a CBA-recognized college/university or program?

The CBA will not be recognizing colleges or universities, so students will have the flexibility to attend the accredited school of their choosing. The CBA will, however, be recognizing specific degree programs as meeting the minimum educational requirements for licensure, but students are not required to attend schools with degree programs recognized by the CBA. The only difference will be that students who achieve a recognized degree will not require a course-by-course transcript review from CBA staff.

How are the examination requirements being changed?

The bill requires the examination and licensure educational requirements to be the same; namely, a baccalaureate degree and a concentration of accounting-related courses. The accounting concentration unit requirements will be established in regulations. The CBA has engaged in stakeholder input on what the unit requirements for the accounting concentration might be and directed staff to write regulations consistent with the following:

- 24 semester units of accounting courses

- 24 semester units of business-related courses (extra accounting or ethics units also count here)

- 3 semester units of ethics

Quick Hits

Upcoming Events